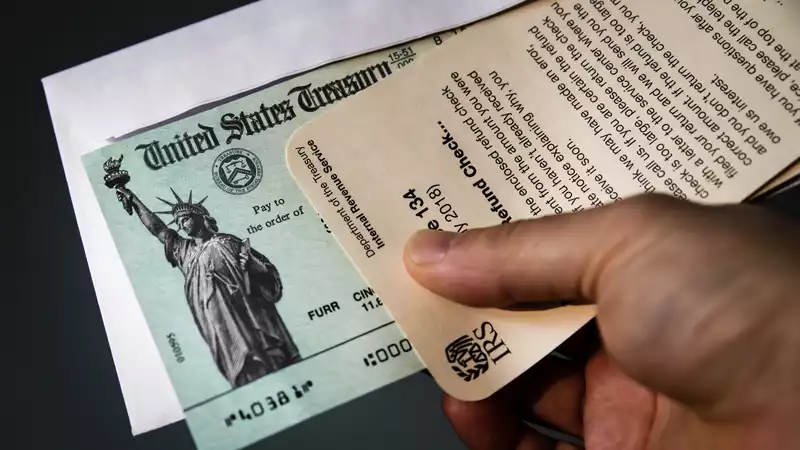

The first round of stimulus check payments began earlier this spring

It has proven to be a slow process to distribute the $2 trillion in aid, and payments may have been delayed for a variety of reasons, including income level and account transfer information issues, delays in mailing paper checks, etc

If you are still waiting for your first stimulus check, you can check your payment status using the IRS Get My Payment app You can also set up a stimulus check notification in the USPS Informed Delivery tool to receive an alert when your check or stimulus check debit card arrives in your mailbox

Finally, if you cannot find your check, you can call the IRS stimulus check phone number and speak with a representative

Here are some reasons why your first stimulus check may be missing

The stimulus under the Cares Act provides $1,200 to single taxpayers earning less than $75,000 and married taxpayers earning less than $150,000 For those with higher incomes, benefits are prorated up to $99,000 for single filers, $146,500 for heads of household, and $198,000 for married filers

If you exceed these income limits, you will not receive a stimulus check at all

The Kearns Act also limited the funds to individuals with Social Security numbers If they instead file their tax returns using their taxpayer identification numbers, they will not be eligible for this relief

To find out how much you are eligible to receive, use this stimulus check calculator The only information required is whether you filed a tax return, the number of children you have, and your adjusted gross income for 2019

When the IRS began disbursing the stimulus checks in April, it estimated that it would take up to 20 weeks to reach all paper check recipients (those who have not registered their direct deposit information) Because the checks are sent in order, starting with those with the lowest incomes, those who have reached the maximum income limit may see a delay in receiving their checks

The IRS attempted to have everyone with a bank account submit their direct deposit information by mid-May in order to expedite the processing of stimulus payments Those who did not did so will have to wait for a paper check or a stimulus debit card (another reason why their payments may not have arrived yet)

If you entered your account transfer information, or if the IRS already has your account transfer information for a previous tax year, there are several potential problems One is that the account information is out of date or incorrect, and the IRS will have to send you a paper check Another possibility is that the bank failed to process the electronic tax payment, which would also result in a check being sent to you

Some people have received a "payment status unavailable" message when using the IRS check status tool One possible reason is that the IRS is still processing their 2019 tax return or an unfiled tax return filed online

If you did not file a tax return in 2018 or 2019 and have not submitted a non-filer form, you will need to file your tax return before the IRS sends you your stimulus check

As reported by MarketWatch, the Cares Act does not prohibit debt collectors from seizing stimulus funds Also, if you are paying child support, the IRS may reduce your benefits or not pay them altogether If your stimulus check was used to cover past child support payments, you should have received notice

Comments