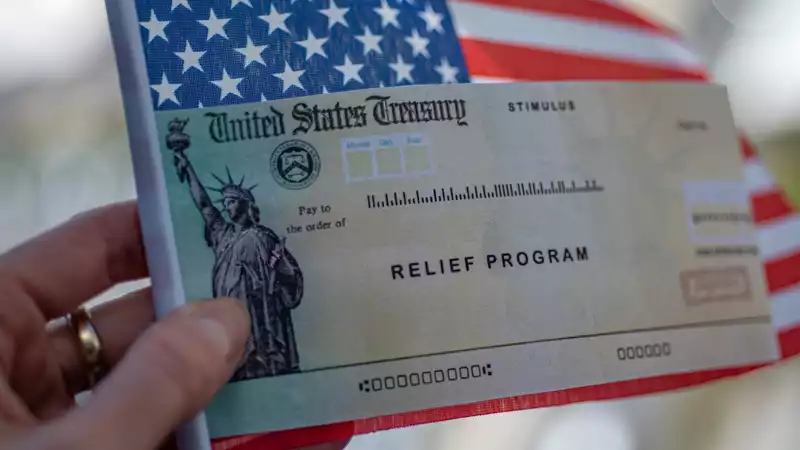

Stimulus Check 2 is a direct payment plan included in the HEALS Act that is currently being debated by lawmakers The Senate is working on enacting another COVID-19 relief bill, which may include a second check for $1,200 for eligible Americans

The HEALS Act has not yet been approved, but we do know that the proposed version of the stimulus bill would provide another round of payments to certain individuals and families

So who qualifies for benefits under the current stimulus check 2 eligibility framework?

The HEALS Act stimulus package has eligibility guidelines similar to the CARES Act stimulus package

Workers earning less than $75,000 per year (if single) or less than $150,000 per year (if married) would expect to receive $1,200 in Stimulus 2 To find out how much you would receive under Stimulus 2, enter your tax information into the Stimulus 2 calculator

Low- and moderate-income taxpayers: Single taxpayers earning less than $75,000 per year and married taxpayers earning less than $150,000 per year are eligible to receive the full $1,200 benefit, which begins to phase out as income increases Taxpayers who are single and over $99,000 and married and over $198,000 are not eligible for the benefit

Families with dependents: like the CARES Act, the HEALS Act proposes $500 per dependent

College Students and Older Dependents: The HEALS Act extends the $500 benefit to all dependents, including dependents of adults with no income The CARES Act excluded these dependents

Higher-income taxpayers: Under the current version of the HEALS Act, single taxpayers with incomes of less than $99,000 and married taxpayers with incomes of less than $198,000 (joint filers) are eligible for some benefits Any income above that would not qualify for the stimulus package However, the income limits could change as the bill moves forward

Individuals Excluded by the Careers Act: The first round of the stimulus package excluded not only high-income individuals, but also dependent children over age 16 and immigrants who pay taxes but do not have green cards

If you are still waiting for your first stimulus check, use the IRS Get My Payment app to track your payment status and set up a stimulus check notification in the USPS Informed Delivery tool to receive a check or stimulus check debit card in your mailbox to receive a notification when the check or stimulus check debit card arrives at your mailbox

You can also call the IRS stimulus check phone number to speak with a representative about the whereabouts of your check

Comments